Different Car Write-Off Categories Explained

Understand The Different Types Of Write-Offs With Our Guide…

Quick Links

- Introduction

- What Is A Write-Off?

- What Are The Financial Implications Of A Write-Off?

- What To Do If You're Involved In An Accident?

- Different Car Write-Off Categories Explained

- Category A

- Category B

- Category S (Formally Cat C)

- Category N (Formally Cat D)

- Why Do Some Cars Get Written Off For Minor Issues?

- Can You Buy Back A Written-Off Car?

- Will A Write-Off Affect Insurance?

- Is Buying A Previously Written-Off Car A Good Idea?

- Our Final Word

Introduction

Nobody wants to hear that their car’s a write-off. It’s one of those phrases that makes your stomach drop, right up there with “your MOT’s expired” or “it’s going to cost more than it’s worth to fix.”

Don't worry though; not all write-offs mean your car’s destined for the scrapyard. Understanding how write-off categories work in the UK can help you make better decisions, whether you're dealing with an insurance claim or buying a second-hand car.

In this guide, we’re breaking down the jargon, explaining each write-off category, so you’re in the know. First though, let’s take a look at some of the basics.

What Is a Write-Off?

When the cost of repairing a car outweighs its current market value, or when fixing it simply isn’t safe or sensible, it will be declared a write-off (or total loss). Whilst insurers usually make this call after assessing the damage and estimating repair costs, it doesn’t necessarily mean the car is beyond salvage. A write-off is more often concerned with money, which is where write-off categories come in.

What Are The Financial Implications Of A Write-Off?

If your car is a write-off, your insurer will offer you a ‘final settlement figure’; the amount they’re willing to pay out to you for your vehicle.

The problem is, cars can depreciate much quicker than finance repayments, so you may be left out of pocket. If your car has negative equity, where the car is worth less than you still owe, your settlement figure might not cover everything you need to pay off.

Gap insurance exists to protect you against this shortfall, something you should consider if you’re worried about being ‘on the hook’ for finance following a write-off.

What To Do If You're Involved In An Accident

Write-offs and accidents go hand in hand, but not everyone knows what they should do if they're involved in one. Here's a video explaining everything you need to know:

Different Car Write-Off Categories Explained

Category A | Complete Write-Off

A Category A (Cat A) is the most severe type of write-off, where the damage is so extensive that nothing, not even the spare parts, can be salvaged.

These vehicles must be crushed, with no ifs or buts.

You’re not allowed to buy it back, and it shouldn’t ever see the road again.

Category B | Break Only for Parts

Although a Category B write-off is slightly less dramatic than a Cat A, it’s still game over as far as the road’s concerned. A Cat B car can’t be driven again, but some of the parts may be salvageable for sale.

Mechanics or breakers yards usually buy Cat B cars, strip them for anything useable and dispose of the rest.

If someone tries to sell you a Category B write-off for road use, walk away, or better yet, report them using the GOV.UK website.

Category S (Used to be Cat C) | Structurally Damaged, But Repairable

Formally known as a Category C, a Category S write-off brings more complications than a Cat A or B. A Cat S vehicle has sustained structural damage, such as a bent chassis, damaged crumple zones or compromised suspension. However, they can, technically, be repaired and legally returned to the road.

Repairing Cat S write-off cars takes time and money, which is why they’re usually repaired by a specialist.

Once the work is complete (and inspected), the car can go back on the road for everyday use. Remember, though, even a fully repaired and inspected Category S car will carry that tag, which can affect its saleability, resale value and equity.

Category N (Used to be Cat D) | Non-Structural Damage

These are often the most misunderstood write-offs. Cat N cars haven’t suffered any structural damage, meaning the main framework is still sound; the issues usually lie with electricals, bodywork, or cosmetic areas like doors, bumpers, or trim.

They’re often written off due to the sheer cost of replacement parts or labour, but from a safety perspective, they can be fixed and made roadworthy again.

Some Cat N cars are absolute bargains, whilst others are expensive headaches. The trick is knowing which is which.

If you’re considering buying a Category N car, we recommend a pre-purchase inspection before you commit to buying, for added peace of mind.

Read More: Pre-inspections aren’t reserved for written-off cars; see how a pre-mot inspection could help save you money on your current car.

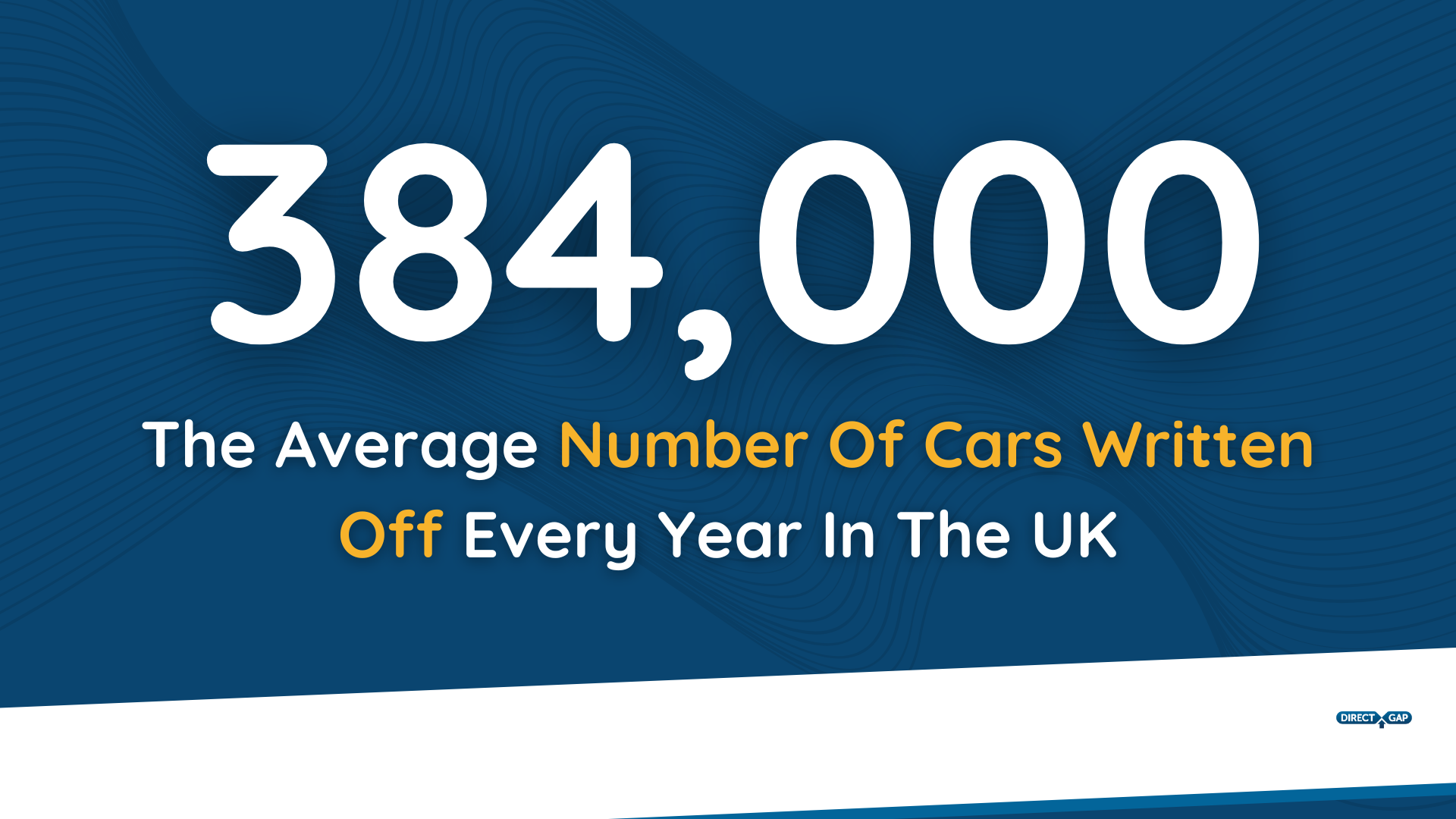

A car is written off in the UK every 90 seconds!

Why Do Some Cars Get Written Off For Minor Issues?

Often, it comes down to simple economics. If the car’s not worth much to begin with, even moderate repair costs can tip it over the edge.

So a ten-year-old hatchback with £1,000 worth of damage might get written off, while a newer SUV with £3,000 of similar damage wouldn’t.

It’s not always about how bad it looks; it’s how much it costs to fix, relative to the car’s value.

Can You Buy Back a Written-Off Car?

If it’s Category S or N, insurers might let you buy the car back at its salvage value.

You’ll need to pay for repairs out of your own pocket and ensure it passes any required inspections (like a VIC check, depending on the circumstances).

Make sure you fully understand what you’re getting into. Some Cat S cars look fine on the outside but have serious issues underneath.

Top tip: Always get a full history check and have a trusted mechanic look over the car before committing.

Will a Write-Off Affect Insurance?

In short, yes. Most insurers will want to know if your car’s previously been written off. You’ll also find that Cat S and N vehicles can sometimes cost more to insure and not every insurer will cover them.

As we’ve already mentioned, come resale time, the market value’s likely to be lower, even if it’s been beautifully repaired.

So, while you might grab a deal upfront, make sure you’re not paying for it long-term.

Is Buying a Previously Written-Off Car Ever a Good Idea?

If the repairs were done properly, the price is right, and you’re not fussed about a ding to resale value, then it might just be a savvy move.

Just don’t buy blindly. A shiny exterior doesn’t mean everything is ok under the bodywork. Insist on paperwork, get inspections, and know exactly what you’re driving away in.

Our Final Word

Write-offs aren't always death sentences for cars, but they do require caution.

Whether you're trying to understand your insurer’s decision or considering buying a Cat S runaround, knowing the differences between categories can save you time, money, and a lot of stress.

If in doubt, ask questions. Do your homework. And don’t commit to anything you feel uneasy about.

We hope you’ve enjoyed reading this and found it useful. if you have any questions, please don’t hesitate to get in touch with us, we’re always here to help!

Pin It!