Should You Buy, Return Or Upgrade At The End Of Your PCP Deal?

Make The Right Choice At The End Of Your PCP Deal With Our Advice…

PCP can be a great way to get into a nicer, newer car than you normally would paying cash or via HP (Hire Purchase), with lower, more manageable monthly payments (subject to your circumstances), thanks to the deferred optional final payment.

However, unlike the simplicity of HP, buying outright or even leasing, PCP can often be confusing when it comes to the end of the term, especially for first-time ‘PCP’ers’. What exactly are your options and which is the best for you?

In this article we’re looking at the three core options; buy, trade in, or hand back. First, though, let’s look at some of the basics of PCP…

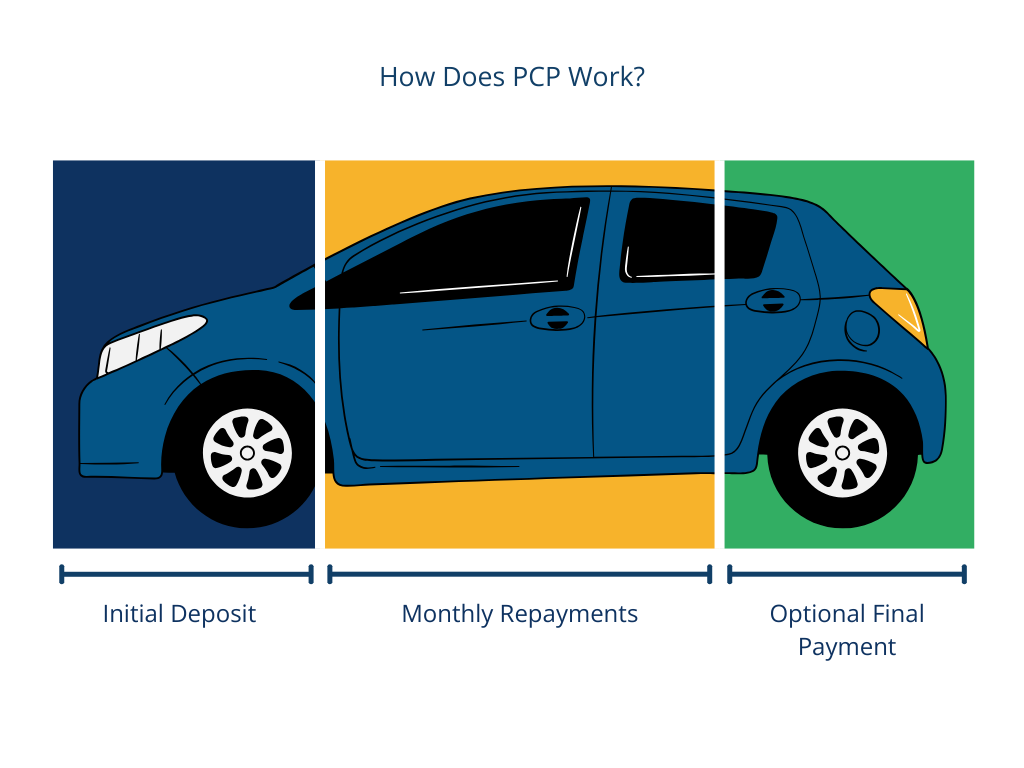

How Does PCP Work?

PCP usually works in three steps; an optional deposit, typically around 10% of the car’s value, regular monthly repayments and an ‘optional final payment’.

This optional final payment essentially ‘offsets’ some of the financing to the end of the agreement, meaning lower monthly payments. There’s no hard and fast rule on the optional final payment amount, but the higher the amount, the lower your monthly repayments.

As you reach the end of your PCP term, you have three options:

- Pay the optional final payment and own the car outright

- Trade the car in, using any equity towards your next car

- Hand the car back without paying the optional final payment and walk away

Read: Common PCP Mistakes That Could Cost You Money

How Popular Is PCP?

If you have or are considering PCP you’re in good company. In the UK (in 2022), PCP accounted for 80% of all new car sales and 41% of all used sales.

Should You Buy, Return Or Upgrade At The End Of Your PCP Deal?

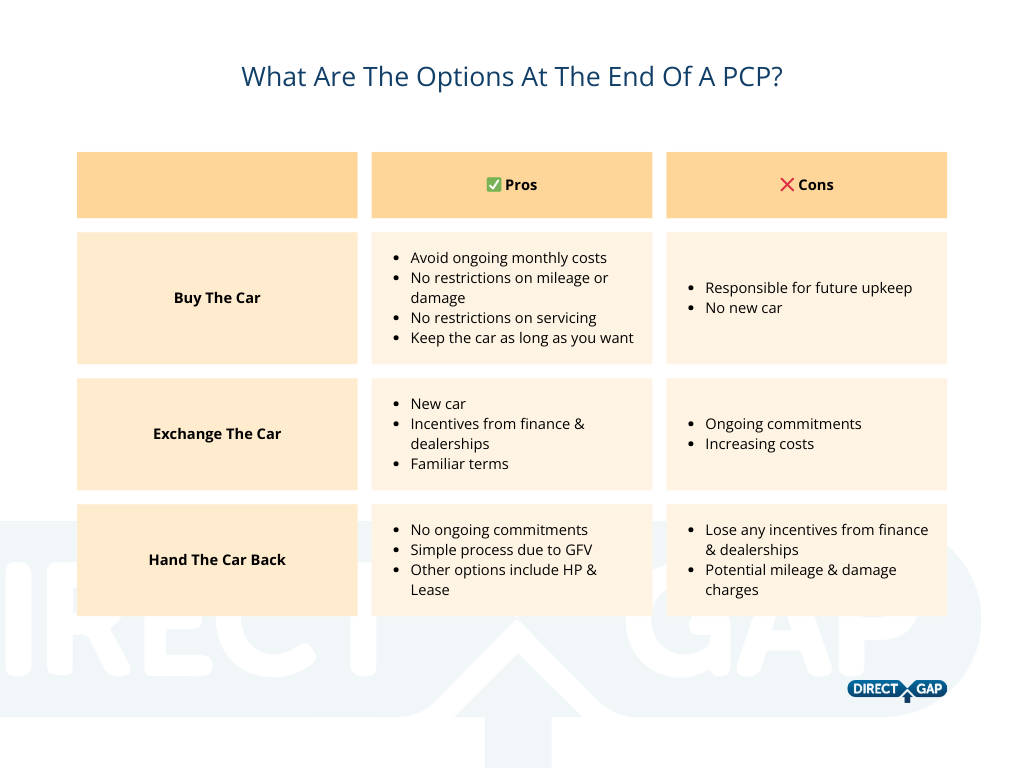

Whether you exchange, buy or give up your car at the end of your agreement is a personal choice with benefits and drawbacks to all. Before you make a decision it pays to understand the pros and cons so you get it right, without any remorse and, if applicable; get the best deal for you.

Here’s a breakdown of each:

Buy The Car

Paying the optional final payment and owning the car outright is a good idea if you want to avoid ongoing monthly costs. Owning the car also means driving with more ‘freedom’, not worrying about mileage restrictions or keeping the vehicle in premium condition.

Once you’ve bought the car outright you can keep it as long as you like, potentially minimising depreciation (which occurs more rapidly in newer cars).

However, you’ll also be responsible for the future upkeep of your vehicle, including MOTs and servicing which could become increasingly costly. Although most PCPs don’t render you entirely devoid of responsibility, you’ll be liable for any major mechanical faults (which may have been covered previously).

Trade-In The Car

If you don’t want to own the car you're currently driving you could trade it in towards another PCP deal. Most people choose to do this as it means a new car on roughly the same monthly terms.

In some cases, dealerships or finance companies will offer incentives or discounts for you as a returning customer (such as a deposit contribution), but you should always be prepared to pay another deposit contribution yourself, otherwise, you could face increasing monthly costs (as the cost of car buying generally increases year on year).

Our Advice: In a PCP with around 6-12 months left? Give your dealership a call! Often, dealerships will want to keep your business with them, so they may have a deal lined up for you; whether that’s a contribution towards your deposit, favourable part exchange terms of a discount off your next car. (Please consider your circumstances and any consequences such as negative equity if you end your term early).

Trading in your car towards a new one also means you aren’t driving an ageing model, so you’ll have more peace of mind with reliability and servicing.

One of the downsides to trading your car in is the commitment to another PCP term with all the restrictions on mileage, damage and servicing, which limit your motoring flexibility. If you aren’t regularly ‘topping up’ your PCP with a deposit contribution, the chances are your monthly repayments will become increasingly expensive over the long term too.

Similarly to leasing, continual PCP means you’ll never truly own your vehicle, creating a reliance on financing, something to consider when budgeting mid and long-term.

Return The Car

Returning the car at the end of your term is a relatively easy option; residual value is usually pre-determined at the start of the contract (known as the Guaranteed Future Value or GFV) so you shouldn’t face any negative equity issues.

Handing the car back is a good option if you’re looking to reduce your monthly commitments (as you can find a finance-free alternative), switch to another type of financing such as leasing or if you’ve seen a car elsewhere that your current dealership can’t facilitate.

Remember, if you decide to start a PCP elsewhere you’ll probably have to make another deposit payment and lose out on any potential finance ‘rewards’ (such as a Manufacturer Deposit Contribution).

Furthermore, if you hand your car back it will be subject to checks such as damage and additional mileage. If your car has unexpected bumps, scrapes, kerbed alloys or damaged tyres you’ll be expected to ‘make the car good’ or pay for the repairs. As well as this, if you have gone over your allocated mileage (determined at the start of your contract) you’ll be liable for a surcharge.

Refinancing

In some limited circumstances, you can choose to refinance the optional final payment in isolation, effectively, taking out a loan to cover the cost of the balloon payment and then repaying monthly.

Refinancing spreads the cost and makes what can be a daunting lump sum more manageable, whilst also providing some level of flexibility (as you’re no longer beholden to the terms of the PCP); which can be attractive, particularly if you’re still enjoying the car you're in. Furthermore, refinancing can help minimise charges (paying the optional final payment) by removing any damage or mileage surcharges you’d face by handing the car back or trading it in.

Don’t forget that refinancing your optional final payment is extending your debt, with the usual credit checks attached (despite how dealerships may pitch this). Terms may change from your original PCP too.

Understanding The Pros & Cons Of Each Option Can Help You Best Decide What To Do.

Negative Equity And PCP

Negative equity is a worry for most car owners who are financing a car in one way or another, including PCP. With depreciation often reducing the value of your vehicle at a higher rate than you’re reducing the finance balance (through repayments) you could be left in a situation where you owe more than the car is worth; this is negative equity.

How Does Negative Equity Affect PCP?

Returning Or Trading In Your Car

Whilst the Guaranteed Future Value ensures your exchange or return price is equivalent to your balloon payment, this doesn’t account for higher mileage or damage (which causes more depreciation than expected).

Therefore, if your car is involved in an accident or you’ve driven more than your plan accounts for it may be worth less than the final payment.

Our Advice: You’ll be able to estimate in advance whether your mileage will exceed the pre-agreed level set out in your PCP contract. If this is the case, our advice is to call your car dealership or finance provider as soon as possible to notify them. In most cases, they can recalculate your monthly repayments to cover this, which is usually much cheaper than paying any mileage surcharges.

To protect against minor damage, which will impact the final value of your car and ultimately cost you money, consider Alloy Wheel Insurance and Scratch & Dent Insurance to reduce your risk of costly repairs and ongoing problems.

Ending Your Contract Early

Many people end their PCP contract early, usually, to swap for a newer car more quickly. However, as the vehicle will have depreciated over the term this often leaves drivers with a negative equity shortfall; where the value of the car at the early trade-in time is much lower than the amount still outstanding on finance.

When this occurs (which can be quite common) most dealerships will offer to ‘roll’ the negative equity into the next PCP deal using a negative equity loan. However, these will increase your costs and can be quite costly, as you’re effectively financing debt from your old car, whilst taking on new debt for another.

Our Advice: It’s always expensive to end your car financing early, so we’d recommend sticking with your car to the end of the term. However, if you’re set on ending your contract early, be prepared to add a cash injection to your deal with a bigger deposit, otherwise, you’ll see increasing costs over the years.

If you’re always tempted to end your PCP contracts early, thanks to the draw of a new car, consider asking your dealership for a shorter contract. Whilst this may cost you more money per month, it means you have the option to renew more frequently.

Accident, Fire Or Theft (Total Loss)

Following an accident, fire or theft your car could be declared a ‘Total Loss’, which means your insurance company deems it beyond salvage. If this happens they will offer you a settlement figure representative of the car’s value at the time.

If your car is on PCP this could cause an issue. If your car has depreciated in value and you’re currently in negative equity then you’ll have a settlement figure lower than the amount you still owe, which you are liable for.

Our Advice: If you’re purchasing a car through any type of finance, it’s worth considering Gap Insurance such as Return To Invoice Insurance (which is available for PCP cars). With depreciation being an inevitable part of most car ownership gap insurance can offer peace of mind, knowing that you’ll not be facing a financial shortfall if your car is written off; as gap insurance will pay the difference between your settlement figure and the outstanding balance (depending on policy).

Our Final Word

As we always say, don’t shy away from PCP. Although the options at the end of your term can be daunting, PCP is still one of the best ways to buy a new or nearly new car with lower monthly repayments, part of the reason it’s so popular in the UK.

Although there are some changes you’ll have to make, such as driving within your allocated mileage a PCP still delivers most of the benefits of new car ownership, with much less financial strain.

When it comes to the end of your PCP be sure to brush up on your options and discuss each with your dealership before committing, as we’ve discussed; each has benefits and draw backs.

If you’ve enjoyed reading, please share this article with your friends and social media and, as always, if you have questions, please get in touch with Luke. DM him on social media and he’ll be happy to help.