Essential Tips For First-Time Car Buyers

Ready To Hit The Open Road? Make Sure You Do It In The Right Car, With Our Latest Guide...

Getting on the road for the first time is one of the most exciting milestones in life. Passing your test and finally feeling that true sense of freedom is unmatched. With it though, comes the daunting (yet exciting) task of buying your first car.

Since you may not have much experience, the process can seem a bit overwhelming but don’t worry there are a few core considerations that, if you keep in mind, you’ll make the right choice and be happy with your new wheels.

In this guide, we’ll walk through the key things you need to consider when buying your first car, complete with insider tips to help you make the perfect choice.

Essential Tips For First-Time Car Buyers

Budget

How much you want to spend on your first car is down to personal preference. One thing you will need to think about though, is whether you want to buy your car outright or use some level of financing.

Here’s a brief overview of the most popular types of car financing to help you figure out which (if any) is best for you:

- Hire Purchase (HP): HP is essentially a car loan where you finance the full value of the car (minus any deposit) and make monthly repayments.

Throughout the agreement term you’re ultimately responsible for servicing and maintenance (although there aren’t usually any stipulations on how frequently this needs to be done on HP). At the end of the agreement, the car is yours.

HP is considered the most ‘straightforward’ method of car financing. It usually has the biggest monthly repayments but offers the benefit of simplicity and knowing the car is yours at the end of the term. - Personal Contract Purchase (PCP): PCP involves a deposit and monthly repayments, generally lower than HP, as some of the cost is offset to the end of the term (via an ‘Optional Final Payment’).

You can either pay the final amount (often referred to as a ‘Balloon Payment’) to keep the car. Alternatively, you could trade it in or return it without obligation.

PCP is a good ‘go between’ for those looking to own their car outright without expensive monthly repayments. They currently account for around 80% of all car financing deals and are a particularly popular option for used cars. - Leasing (PCH): With leasing (or ‘Personal Contract Hire’ as it’s officially known), you pay for the car’s use rather than its ownership. Monthly payments usually cover depreciation plus fees; meaning you can get into a new vehicle more easily.

Leasing lets you drive a new car without ownership but can be more costly over time. Remember, at the end of the lease term you have to source another vehicle, effectively continuing financing indefinitely.

What’s more, leasing may come with stipulations on servicing, minimum service terms and insistence on main dealer usage; something you should look into before committing.

PCH is becoming increasingly popular on new cars but payments can vary considerably depending on the car you choose. Conversely, cars that depreciate at a higher rate can often be more expensive to lease, as you are covering that loss.

Used or New?

For first-time buyers, a used car is often the sensible choice since there’s a higher chance of minor bumps and scrapes when you’re just starting out driving unaided; which is less ‘important’ or stressful than in a brand-new car. As well as this, used cars tend to depreciate more slowly than brand-new cars which means you’ll ultimately ‘lose’ less over its lifetime (Read more here about: Why Do Cars Depreciate).

Used small hatchbacks are a staple of the first-time car market, so you shouldn’t necessarily shy away from them, just make sure you do some thorough research before buying, looking at service history and previous ownership in particular.

It’s a slight misnomer that smaller engines can’t handle high mileage. However, we still recommend finding a used car with lower mileage, particularly if you’re shopping in the 1.0litre to 1.6litre petrol engine range.

New cars shouldn’t be overlooked either! Many manufacturers offer great incentives for new car buyers, meaning you could get a great deal and enjoy the experience of driving something brand new. In rare cases, manufacturers may even throw in a year's worth of insurance, something which could save you some serious cash (with terms & conditions attached, of course).

Car Insurance

Insurance costs are a major factor for first-time drivers who don’t benefit from any accrued no-claims bonuses. Every car has an insurance group rating from 1 to 50, with 1 being the cheapest to insure and 50 being the most expensive (as a general rule of thumb).

Cars in the lower brackets, such as insurance groups 1-5 include cars such as the Ford Ka, smaller-engined Renault Clios and Fiat 500’s; all excellent choices for the budget-conscious first-time buyer.

It’s worth noting that insurance groups are intended as a guide only, with some insurers not directly conforming to each rating; we recommend getting a quote for every car you’re considering as these are usually valid between 10-30 days, giving you plenty of time to decide.

What Factors Affect A Car’s Insurance Group Rating?

There are a number of factors which impact the insurance group rating (therefore, insurance premiums) of any car including:

- Price: More expensive cars are more expensive to replace following an accident or total loss. Pricier vehicles such as sports and luxury cars are often in the highest graded insurance brackets.

- Cost Of Repairs: Common cars with plentiful parts are easier to repair and as such, are generally placed in lower (cheaper) insurance brackets. Contrastingly, exotic and limited-run vehicles are more expensive to fix, meaning a higher insurance rating and premiums.

- Performance: Higher perfoming cars can be more susceptible to high speed crashes with greater risk. The result? Most high-powered cars will be on the higher end of insurance ratings.

- Safety & Anti Theft: Safety features such as assisted breaking can help lower a car's insurance group. Generally, higher NCAP-rated cars have lower insurance ratings as they are deemed safer than other cars. This is also true for those with enhanced anti-theft measures such as factory-fitted alarms and immobilisers, which make the car a ‘lower risk’.

Road Tax

Road tax, or Vehicle Tax, is based on your car’s age, emissions, and other factors. Using an online car tax calculator can give you an idea of annual costs and help you make an informed decision.

On the whole, smaller cars will incur fewer charges than bigger engines or more powerful cars that produce more emissions, but you should always check first.

These days car tax can be paid in one lump sum, or monthly, which can help you budget more efficiently. Whilst there's a small surcharge for paying monthly (usually a few £’s over the year) we recommend it as it’s easier to cancel, should you sell your car, or have an accident, rather than trying to claim back car tax already paid, retrospectively.

MOT, Servicing & Upkeep

Ownership costs extend beyond the purchase price of your new car. Here are some of the less obvious costs of car ownership that you should factor into your decision process:

- Age & Mileage: Older cars will inevitably need more in-depth servicing which could mean higher costs.

- Scarcity Of Parts: If you’ve chosen a discontinued model or one that isn’t (or wasn’t) massively popular then aftermarket parts may be in short supply; meaning higher costs.

- Engine Type: A powerful engine or one considered ‘more complex’ could incur higher costs for repairs and servicing where more time is needed to work on it. If you have a high-powered engine in a smaller engine bay, for example, you should expect more intricate work and in some cases, the need to remove an engine (on bigger jobs).

- Make & Model: Popular car makes and models are generally more accessible to independent garages, therefore, you have more (cost-effective) options for MOTs, servicing and upkeep.

As we mentioned earlier, depending on the finance type you choose for your car, you may be required to use main dealer servicing which is usually more expensive. Be sure to check the fine print if you decide to finance your car (particularly through PCP or Leasing).

If you’re concerned about maintenance costs it’s worth talking to your dealership (or salesperson) about a ‘Service Plan’, which helps spread the cost of servicing. What’s more, these fees can usually be included in any financing you choose, meaning you don’t have to pay the entirety up front.

Fuel

Although electric and hybrid cars are hot property right now, we say don’t ignore petrol or diesel for your first-time car buying. You might end up paying more in road tax but you could save thousands on initial purchasing price if you’re less fussy on fuel type.

Petrol cars are renowned for short, urban drives, making them the perfect choice for smaller city commutes and driving around town. Despite this, they are adept at longer journeys too, equally comfortable racking up the motorway miles.

Diesel engines, which have developed a bad rep over the last few years, shouldn’t be overlooked. They’re great for longer driving, such as longer motorway commutes and despite a commitment from the government to phase out new diesel sales by 2035 they’ll still be around for a while.

Thanks to this uncertainty diesel powered cars can usually be picked up for a better price than their petrol or EV counterparts. However, you should also expect to see a greater depreciation, especially if you own yours for an extended period.

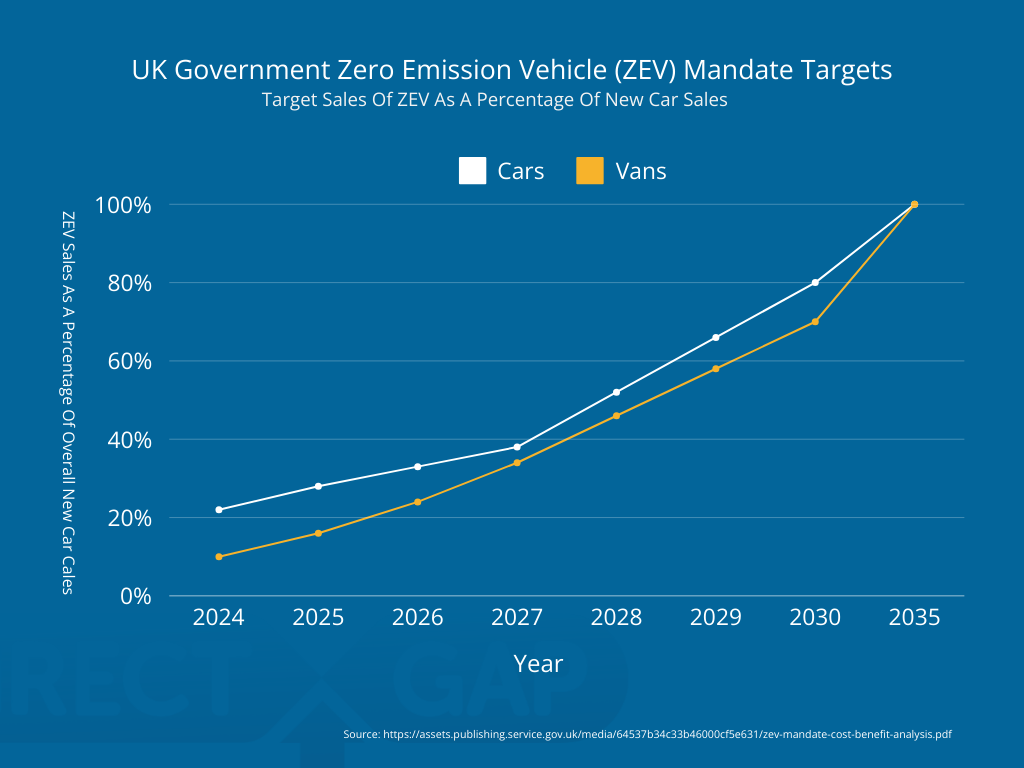

As for hybrids and EVs the benefits are numerous and well documented. What’s more, as there’s a general push towards electric vehicles (with the government mandating 22% of all new cars in 2024, 80% of all new cars in 2030 and 100% of all new cars in 2035 sold should be electric) there are plenty of dealership incentives out there at the moment; so shop around for a bargain.

UK Government Zero Emission Vehicle (ZEV) Mandate Targets

If you do opt for electric make sure you thoroughly research charging options and find a car with a range to suit your lifestyle. We also recommend removing ⅓ of any manufacturer's range figures, to give you a genuine, ‘real world’ idea of what yours could really achieve.

Our advice: If you’re going used, we’d recommend a small petrol engine car; the performance will suit most first-time drivers and delivers the best value for money. If you’re choosing a new car, seriously consider electric; cost is probably less of a factor, but there are plenty of options out there, including many exciting new models and finishes.

Practicality

Consider your specific needs, like whether a two or four-door model is more suitable. If you regularly drive passengers or have young children, four doors are essential for convenience.

With smaller cars, boot space is at a premium, but most hatchbacks will still have plenty of room for shopping and the occasional weekend getaway.

Performance & Extras

There are hundreds of extras out there, too many for us to cover them all here. Instead, we’ve picked a few that we think most first-time buyers should think about:

Apple Car Play Interface

- Apple Car Play & Android Auto: Apple Car Play and Android Auto provide a simplified version of your mobile phone through your car stereo interface, allowing you to make calls, change songs and much more, hands free and more safely.

We recommend it for distraction-free driving, reducing your risk of police fines and minimising your involvement in an accident. (Remember; laws around hands free driving can and do change, please familiarise yourself with these and take this as a guide only).

- DAB Radio: Depending on your age, a radio might not be at the top of your priority list. That said, a DAB digital radio is a welcome addition to most cars as it delivers crystal clear service throughout the UK (unlike older FM radios which are hit and miss).

As well as this, DAB offers a wider variety of stations, making those inevitable road trips all the more enjoyable.

Typical Parking Sensor Fitment

- Parking Sensors: A self-explanatory optional extra that should be number one on every first-time drivers list! Parking sensors come in a variety of options, from the basic reverse parking sensor to 360 and birds eye parking screens.

We recommend looking for a car that has at least a reverse parking sensor which makes those daunting manoeuvres such as parallel parking and reversing into a bay a little easier, at lease whilst your building your new found confidence.

It goes without saying that a parking sensor can actually save you money in the long run too, reducing those car park prangs and accidental bumps.

Heated Windscreens Make Winter Mornings Much Easier

- Heated Windscreen: In winter, you’ll thank us. A heated windscreen can be a lifesaver in winter months, removing any ice without the need for de-icer or scraping.

TPMS Provide On Dash Info About Your Tyre Pressure Levels

- TPMS: As a first-time car buyer you may be new to regular car checks, which is why we recommend a car that uses a TPMS.

A TPMS, or ‘Tyre Pressure Monitoring System’ will monitor the pressure of each of your tyres and give you a warning on the dashboard if any (or all) fall below the manufacturer's recommended PSI.

Buying Your Car

Where To Look

For used cars, Auto Trader is a great place to start; with options to refine your search by budget, make, model, mileage, fuel type, age and much more. As it’s a long-established website, they have a robust system in place for ensuring buyers are genuine and reliable. However, it’s always worth checking out independent reviews for any potential seller using sites like TrustPilot, Feefo and Google Reviews beforehand.

EBay and Gumtree are good options too, with a wider range of independent sellers. Remember, whilst these might offer lower-priced cars, giving you a better ‘bargain,’ as private sellers, they may not offer the same level of servicing, warranty, or buyer security that you would get from a dealership or high-street car sales.

Manufacturer dealerships are the perfect option if you have a specific model in mind; the ‘scary’ reputation is a thing of the past, with most being extremely helpful and welcoming.

Our advice with dealerships is to go with an open mind and be open to suggestions. It’s also worth noting that if you don’t see anything you like; ask! Most dealerships have a network of cars at their disposal, so if they don’t have something for you on their forecourt, they could potentially source something more suitable elsewhere.

What To Look For

Once you’ve shortlisted a few cars and you’re ready to go and see them, go with purpose. Here are a few things you should look out for when visiting dealerships or independent sellers to make sure you’re buying the right car:

- Mileage & Age: Does the mileage and age of the vehicle seem reasonable, or are there a few too many miles per year? Higher mileage, especially on younger cars can indicate greater engine wear, meaning bigger maintenance costs down the line.

- Service History: Check the service history of any car you're interested in to make sure everything looks above board. Regular stamps from local, consistent dealerships are a good sign.

- Condition: Check the car thoroughly inside and out, paying attention to bumpers, wheel arches and headlights to assess the overall condition, as well as driver's seat wear which indicates the real level of use.

Check the car from a distance to see if any body panels are discoloured, something which could indicate an accident repair. As well as this, checking front and back registration plates can be telling; with mismatched plates indicating a front or rear collision at some point in the car's life. - Test Driving: During the test drive listen out for any unexpected noises or vibrations as well as getting a feel of the drive overall. The drive should be smooth, without any jumping between gears or erratic revving of the engine and idling should also be smooth and consistent.

Our Final Word

Buying your first car, no matter what stage of life you’re at can be both nerve-wracking and exciting in equal measure. On the one hand, you aren’t really sure what to look for, making it all the more likely you’ll buy a ‘dud’, whilst, on the other, you’re so excited that you’ll want to buy the first thing you see which is more often than not, a big mistake.

We hope our guide has broken things down and made the buying process a little more clear. Although you’re probably itching to get out and get on the road ASAP, we hope you take the time to read and make the right choice.

One last thing though, don’t be overwhelmed! Most cars are problem-free, so you probably won’t go far wrong. Choose something you love, drive it with passion and enjoy the open road (safely).

If you have any questions or there’s something you think we haven’t covered here, please let us know! DM Luke via our social media channels and he’ll be happy to help. As always, don’t forget to share this article with your friends if you’ve found it useful.